● Vietnamese people are shifting to consuming more expensive drinks, creating gaps to penetrate into high-end beverage segments. Although both domestic and foreign companies have tried to act in response to this change, foreign companies are currently struggling due to the use of international brands of Vietnamese consumers.

● Besides the improvement in demographic profile, it should be noted that Vietnamese consumers are the most health-conscious people in Southeast Asia, urging producers to start rethinking about adjusting the list of healthy products such as fruit juice or herbal tea. The continuous development of the tourism industry and retail network in Vietnam also serves as a catalyst for the development of the beverage industry as they create higher demand for premium beverage segments as well, such as enhancing the availability of beverage product lines through modern trade channels.

●With a growing proportion of young people (estimated at over 50% of Vietnam’s population under 30 years of age), the income level has improved and the habit of buying processed foods is becoming more popular. The variety and abundance of agricultural products – the source of raw materials for processing food, beverages, etc. are advantages for businesses in the industry to diversify product categories to meet demand. Demand is constantly changing by consumers, and are favorable conditions to help Vietnam become a potential consumer market for beverages in the region.

In the market of beverages, alcoholic beverages (including beer, wine, spirits) are the largest, accounting for more than 70% of the total retail value of beverages. Despite receiving a modest annual growth rate (CAGR) of 3.5% by 2020, the beer industry in Vietnam is considered to have a great opportunity to invest because the country’s consumption is in the top 10 of Asia and a favorable average per capita consumption of 42 liters by 2020. Alcohol and spirits and non-alcoholic beverages are also projected to have a rate of 8% – and 6.1 % -CAGR. According to BMI’s forecast, the actual growth rate of beer consumption will exceed 24.9% in 2018.

In terms of growth, coffee is the product with the highest growth (over 14%), as coffee is gradually becoming the “top choice of young people” in Vietnam recently. At the same time, the increase in income of this group also requires higher quality products, promoting both the quality and quantity of the coffee industry.

Also the main product for young people, soft drinks and soda is also gaining a relatively large market share and stable growth only after coffee. Along with the development of fast food in Vietnam in recent years, soda, typically Pepsi or Coca Cola, are facing fierce competition to win customers’ attention. Not only does it stop investing actively in advertising and brand positioning through all the channels from newspapers, television to internet communication, these soda manufacturers are also trying to change the design and packaging to differentiate and attract customers to increase sales during the year.

Top Players

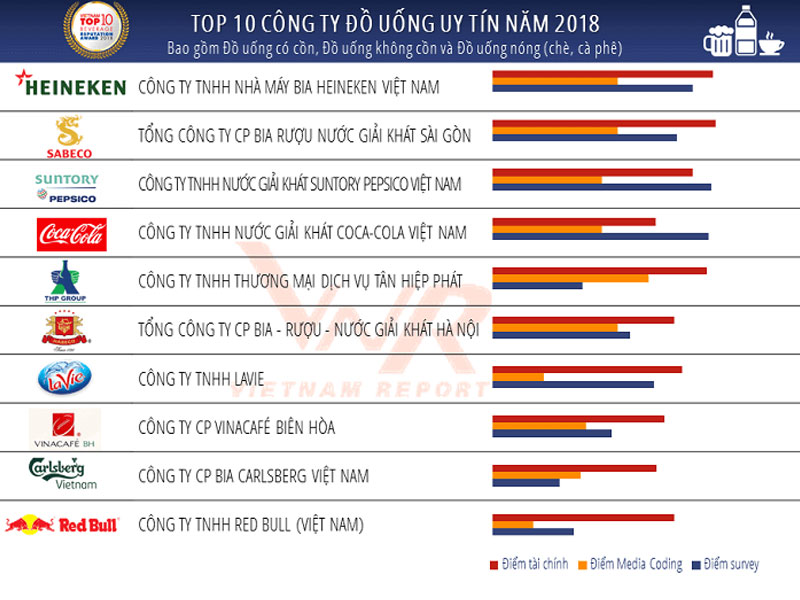

On October 31, 2018, Vietnam Report officially announced the Top 10 reputable food and beverage companies in 2018.

Companies are rated and ranked based on 3 main criteria:

First of all, financial capacity is shown in the most recent financial statements (total assets, total revenue, profit, operational efficiency, capital use efficiency, etc.);

Secondly, media prestige is evaluated by Media Coding method – encoding company articles on influential media channels;

Third, conducting surveys on consumers about the level of awareness and satisfaction with the company’s products / services; survey on experts to assess the position of companies in the industry; and survey on enterprises was conducted in September 2018 in terms of market size, labor, capital, revenue growth rate, profit, operational plan in 2018, etc.

Of the 10 prestigious beverage companies, Tan Hiep Phat Group ranked fifth. Tan Hiep Phat is the only Vietnamese enterprise in the top 5 reputable beverage companies in 2018 but it produces only alcohol-free soft drink products without carbonated water that is good for health. 4 leading positions are 2 brewing enterprises and 2 carbonated-drinks enterprises.

According to Vietnam Report, communication plays an important role in direct connection between manufacturers and consumers, helping consumers identify brand reputation better when making purchasing decisions. However, the results of the media analysis show that the presence on the media of food and beverage enterprises is still limited.

Only 22.9% of the surveyed enterprises had information reaching the awareness level, of which 44% had a minimum frequency of occurrence once a month. In terms of information diversity, 27.4% of businesses have information covering 10/24 number of topic groups that are related to business activities. 3 groups of topics that are most frequently mentioned: Finance / Profit and Loss, Stocks, Products.

In terms of information quality, businesses are rated as “safe” when reaching a positive and negative information gap compared to the total of encrypted information at 10%, but the “best” threshold is over 20%. In the food and beverage industry, there are currently more than 40% of businesses reaching this level of 10%.