Affected by the fluctuation of the international situation and increasing environmental protection pressure, countries have increased their support for new energy vehicles, and promoted the development and popularization of new energy vehicles through various means. At the same time, along with the development and growth of the Internet of Things, intelligence, and 5G networks, the use of high-performance connectors in a wide range has become one of the current development trends in the manufacturing industry. In the field of new energy vehicles, in addition to installing connectors on the original motor management system and other equipment to connect and transmit data and energy, more advanced in-vehicle entertainment systems, intelligent driving systems, and even automated driverless driving, etc. New features also require the use of connectors.

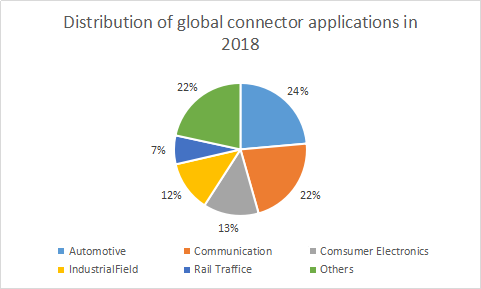

According to data from Bishop & Associates, an independent third-party market research agency, automobiles are the largest terminal equipment application field for connector products at present, and the output value in 2018 alone reached 15.76 billion US dollars, accounting for 23.6% of the global connector market. Affected by the booming development of new energy vehicles, the automotive connector industry will continue to grow rapidly.

Connector companies accelerate the deployment of the automotive field

From the perspective of industry trends, the deployment should be made early. At present, many manufacturers have realized this and have deployed the automotive connector field one after another in an attempt to occupy a dominant position in the expanding market. Taking LUXSHAREICT as an example, as early as 2013, LUXSHAREICT acquired a 100% stake in the German company SuK Kunststofftechnik GmbH and began to enter the automotive parts field. LUXSHAREICT Announcement shows that from 2016 to 2018, the revenue of its automotive interconnect products and precision components was 904 million yuan, 1.131 billion yuan and 1.728 billion yuan, respectively. At present, LUXSHAREICT's automotive connectors have successfully entered the supply chains of Continental Electronics and Bosch.

In 2015, Deren Electronics acquired Meta, a company specializing in the research, development, production and sales of new energy vehicle vehicle chargers and vehicle sensors. As a result, the Italian company, which has a history of more than 40 years, officially became associated with China, and in 2016, it established a production base in Chongqing.

At present, Meta has become a supplier to BMW, PSA, Volkswagen, Porsche, Dongfeng, Geely and other well-known domestic and foreign automakers, and has obtained sufficient orders from many customers. And Deren Electronics has firmly established its foothold in the field of automobile and parts through Meta, and continues to cultivate. In 2017 and 2019, Meta has successively attracted investment companies with a background of Shenzhen state-owned assets to Yuanhai Fuhai and investment company Sichuan Gangrong Group of Yibin State-owned Assets.

A few days ago, Tian Nanlu, the person in charge of Meta, shared in detail the development process and future plans of Meta landing in China in an interview with Securities Times. He said: "The new energy vehicle industry has given us pressure and also brought opportunities. For Meta, we are committed to seizing the development opportunities in the European new energy vehicle market and staying at the forefront of the industry. For Deren Electronics In terms of entering the new energy vehicle industry through the acquisition of Meta, its revenue will reach the tens of billions level. "

New features spawn new trends, high-speed transmission and miniaturization are the trend

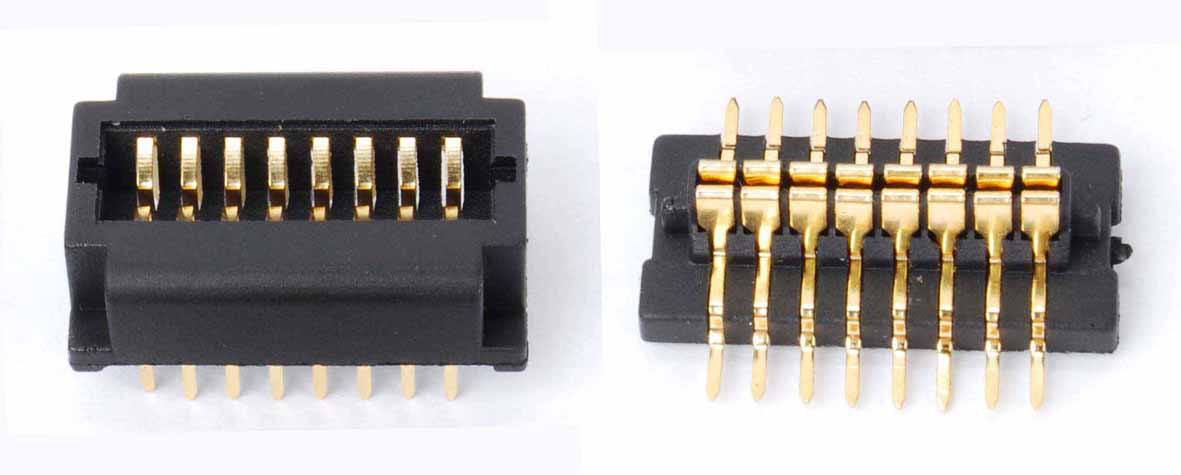

With the emergence, development, and popularization of the Internet of Things, autonomous driving, and 5G networks, cars are becoming more intelligent, prompting a surge in demand for various electronic components, especially connectors, and it is expected that each car will use 600 in the future. With 1,000 electronic connectors, this is far greater than the number used today. Moreover, this is still the case when the interior space of cars is shrinking and the carbon emissions of cars are not reduced. Therefore, to achieve this, high-speed and high-frequency transmission, miniaturization and intelligence of automotive connectors have become the current trend.

Previously, the well-known electronic connector manufacturer Molex has stated in related industry reports that automotive electronic components are continuously expanding their applications, such as powertrains, infotainment systems, automatic and assisted driving, safety systems, and green energy. This is particularly evident in new energy vehicles. According to relevant data, 15 years ago, the average cost of automotive electronic equipment accounted for about one fifth of the total manufacturing cost. Today, that number has climbed to 35% to 40%, and possibly even higher.

According to IHS Automotive's forecast, by 2020, there will be 25.4 million vehicles equipped with display audio infotainment systems worldwide, with a compound annual growth rate (CAGR) of 12%. At the same time, with the concept of entertainment driving, including car audio, wireless mobile communications, GPS navigation and positioning, network data transmission and anti-theft security functions have been continuously adopted, the electronic components used in cars have become more diverse. At the same time, it is expected that the highway will realize the guidance function by 2020, so as to achieve a high degree of autonomous driving on the highway. At the same time, completely unmanned autonomous driving is expected to be realized later in 2025. The advent of the autonomous driving era agrees Promote the automotive connector market to remain high and further increase the requirements for high-speed transmission of connectors.

Also with the popularization of new energy vehicles, the new energy vehicle connector market has become a must for all connector companies. The demand for connectors of new energy vehicles can be roughly divided into two aspects: on the one hand, the number of connectors in automobiles has increased, and the cost of automotive electronics in new energy vehicles has reached 47%; at the same time, the output of new energy vehicles has gradually increased It will be further improved; on the other hand, supporting facilities including charging piles required for the development of new energy vehicles require various types of connectors, including fast electrical connectors.

It can be seen that in the case of limited internal space of the car and even the weight reduction due to environmental protection, the automotive connector must achieve high-speed transmission and small intelligence to meet the needs of automobile development, especially the development of new energy vehicles.

Targeted research and development of new products to adapt to the latest trends in the industry

In view of the new phenomena and new trends in the current automotive connector field, Molex has developed a variety of interconnection solutions for the automotive field. For example, the CMC series hybrid connector uses a high-density, cost-effective sealed modular connection system for heavy-duty, power transmission, and body electronics applications, as well as automotive networking applications. For automotive infotainment and networking systems, it also offers HSAutoLink ™ II components with I / O options for USB 2.0 and 3.0, LVDS, Ethernet, Audio-Visual Bridging (AVB), and Improved HDMI, DVI and DisplayPort. In addition, considering that standard crimp joints cannot provide higher current carrying capacity or good resistance to environmental conditions required for vibration, thermal shock, and automotive applications, they have also developed advanced crimp connectors to address these issues. . Very well meet the current demand for high-speed transmission and miniaturization of automotive connectors.

Deren's wholly-owned subsidiary Meta is focusing on supporting facilities. According to the Industrial Securities Report, the domestic automotive charging industry market is expected to be close to 35 billion yuan in 2020, which is 10 times the current size. With the upgrade of new energy products, the increase of the amount of electricity and the power of the car, the demand for car chargers will increase, and the market will be broad. Meta has comprehensive new energy vehicle supporting facilities systems including on-board chargers, vehicle power control and electric vehicle on-board charging modules, safety and alarm sensors and control units, and car networking modules. Tian Nanlu, the person in charge, said in an interview with the Securities Times: "As long as any industry can achieve the forefront of the industry, there is no shortage of opportunities. The same is true for Meta. In the car charger industry, our goal is to maintain Leading position in the industry. For the company, in a field that has run through and the market has matured, it must consider its own product structure and customer structure to enrich its product system in order to achieve sustainable development. "

In short, the changes in the automotive industry are bringing more changes and growth drivers to the automotive connector market, which will stimulate the connector market to continue to maintain a high level in the future. Of course, while the related companies are trying to occupy more market share, they must also face up to the changes that are taking place in the market and rethink their own future layout and product positioning.