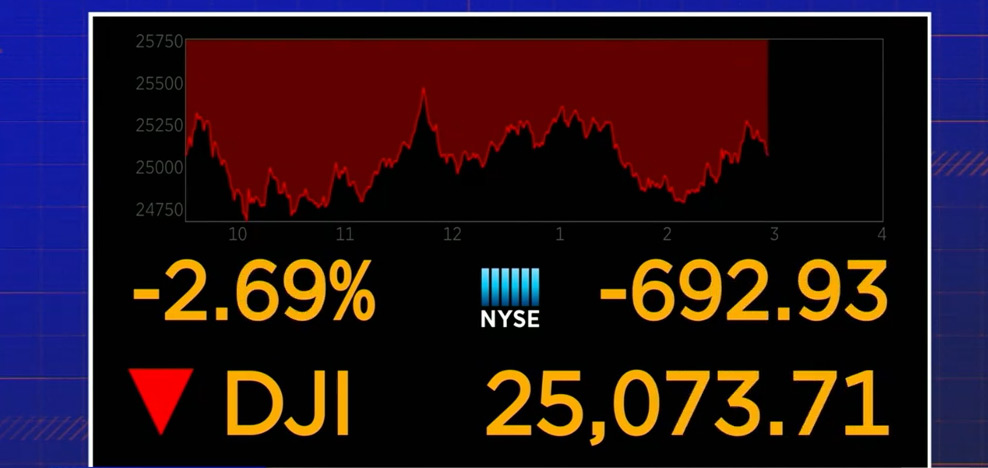

Panic and fear over the corona virus continues on Wall Street stocks posted their worst week since a financial crisis. The Dow fell more than 12%. A loss of about 3500. Points. This came after the Dow fell nearly 12100 points yesterday its worst one day point drop ever. The head of the Federal Reserve trying to calm investors saying the Central Bank was monitoring the virus and would act as appropriate to support the economy. Here to break all of this down ABC's Rebecca Jarvis who is live on Wall Street Rebecca at one point the Dow is down. Close to a thousand points and things could have actually been a lot worse. They could have been worse Lindsay this was a historic week on Wall Street the worst since the financial crisis the Great Recession. Of 2008. And what we've seen on Wall Street is a ripple a fact. Various concerns hitting in vast jurors and their psyches so first it began with the supply disruptions early in the week we heard about companies like apple.

And Nike and Microsoft not getting supplies from factories. In China on time that heavy ripple of fact to other companies we also heard from companies like Mary on and United Airlines this week who have said they see travel weighed down. People are traveling they're afraid of getting sick and many companies like JPMorgan and Amazon are now canceling travel telling their employees Lindsay. Not to travel. All of those things have economic consequences the other side is the virus itself they're still so much unknown so much uncertainty. Around how greatly it will spread here in the United States and how long that will last and one of the biggest things Wall Street is working after at this point is trying to fully understand that because if the US were to look like Italy or China and shot down in the ways that those countries have you see people aren't going out to restaurants they're not traveling they're not going a public place says. That has an economic consequences well Lindsey and it Rebecca any way to tell if we are at or near the bottom. Well I would as a student of history look back and at what we've seen in many other outbreaks and yes these are very different diseases.

Is that the market tends to balance back after about six months to a year. After the outbreak and the economy tends to follow in the same order. And I would also point to the Great Recession what we saw in the Great Recession is that the market from the low is of 2008. Head and 2009. Had bounced back within about three years so if you had sold. That for a one Payer that NASDAQ at a bottom of the market you would've lost at least half of your savings.

Whereas if you would held on for a couple more years you would have made it back and then some Lindsay so is that the take away for the average person at home don't sell hold on. Well look. You have to talk to your financial representatives and have a conversation with baton but. As a student of history as somebody who has a 401K myself. That's what you do you keep it for the long term you put money and you get your company if you have a company that matches you get your company to keep matching and you start thinking about these things when you're twenty so that when you're 65 or seventy you can start withdrawing from that account when it.